Empower data-driven insights and decisions

Denominator is the leading provider of human-centric data and operates in the diversity and sustainability market. The data offerings include both raw data, scores, and ratings on companies globally and which is applicable for use cases such as Investment Management, Supply Chain Management, and Company Benchmarking.

Unlock the social potential of investment portfolios, innovate & enhance ESG products, achieve impactful stewardship & proxy voting efforts, and stay ahead of regulatory requirements by leveraging Denominator’s comprehensive social data insights.

Maximize DEI impact in global supply chains, champion supplier diversity programs and resonate with consumers expectations by utilizing Denominator’s social data & spend insights across your supply chain.

Achieve excellence in internal DEI commitments, identify competitive advantages, attract talent and appeal to investors by measuring, monitoring, and benchmark social performance against industry peers and global standards with Denominator’s global data base.

Investment Management

“We believe that an economically efficient, sustainable global financial system is a necessity for long-term value creation. Such a system will reward long-term, responsible investment and benefit the environment and society as a whole.” (PRI, Mission Statement)

Investors are increasingly moving beyond financial metrics to assess a company’s value, now incorporating environmental and social factors that impact long-term sustainability. Managing negative externalities is crucial, as poor performance on social metrics can jeopardize a company’s social license to operate among stakeholders, including investors, financiers, employees, and customers. Growing evidence shows a correlation between financial performance and social responsibility, particularly in diversity, making it a fiduciary duty for investors to consider these factors. By integrating social and diversity metrics, investors can not only grow the wealth of their beneficiaries and clients but also make a positive social contribution.

There are several reasons for the increased focus on Social & DEI performance within the financial sector, however, these can be grouped into four main categories:

Regulatory

As ESG regulations continue to mature, there is a growing emphasis on the “S” (Social) within ESG. Legislators worldwide are actively crafting diverse regulations that incorporate or place exclusive emphasis on Diversity, Equity, & Inclusion principles. Notable examples include the Sustainable Finance Disclosure Regulation (SFDR), Canada’s initiatives regarding DEI reporting, Nasdaq regulatory requirements, Italy Gender Reporting Law, and the efforts of the U.S. Security and Exchange Commission (SEC), among others. Two central regulatory concepts that further increases emphasis on DEI in investment strategies are “Do No Harm”, and “Mislabeling of Funds”. The latter to ensure the market is not mislead and the former connected to responsibilities of the financial system.

Fiduciary responsibility

Fiduciary responsibility and market share Redirecting capital to reduce global Diversity, Equity, & Inclusion gaps is now regarded by many as a the right thing to do. It also has its ties into the regulatory concept of “Do No Harm”. Both consumers and pension contributors, particularly the younger demographic, are displaying a growing commitment to values-driven choices in their consumption and investment patterns. The threshold for determining what is socially acceptable versus unacceptable is on a steady rise.

Competitive advantage

On a global level, the number of personalized pension products is increasing, driven by their role as competitive differentiators between pension providers seeking to attract new customers. Especially the younger generations are used to personalized options, but options also mean influence. For someone that has a family member with a disability, the option to ensure their retirement funds does not go to the worst performing companies in disability, is a strong factor. Same applies for other minority groups. Companies or unions may also change pension funds provider for similar reasons to increase the options and benefits of their employees or members.

Long term Alpha

While no definitive study has emerged, several studies suggests companies operating in a global landscape can benefit significantly from diverse leadership and workforce (“The Diversity-Innovation Paradox in Science”, “Does Diversity Pay?: Race, Gender, and the Business Case for Diversity”) and covered by several magazines and consultancies (e.g., from McKinsey & Company, Boston Consulting Group, Bain & Company, Deloitte, Harvard Business Review, Forbes): • Cultural Sensitivity: Leaders from various backgrounds are more attuned to cultural nuances, facilitating effective communication and relationships across international markets. • Innovation and Adaptability: Diverse leadership teams are better equipped to understand diverse customer needs and respond effectively to changing market dynamics. • Market Expansion: Companies with diverse leadership can better penetrate diverse markets, leveraging their understanding of local preferences and trends. • Stakeholder Representation: Diverse leadership ensures the inclusion of different stakeholder perspectives, leading to more balanced and ethical decision making.

Deep-drive into exposures and opportunities in global portfolios

Supply Chain Management

Supply chain risk assessments have undergone a significant transformation over the years, reflecting a broader understanding of the myriad of factors that can impact the stability and integrity of global supply networks. Traditionally, these assessments primarily concentrated on financial and geopolitical risks, focusing on the stability of supply chain partners, currency fluctuations, and the impact of political instability or regulatory changes in key regions. However, as awareness of sustainability issues and corporate social responsibility (CSR) has grown, there has been a marked shift towards incorporating environmental and social risks into these evaluations.

This evolution mirrors a global trend towards more ethical and sustainable business practices, driven by both regulatory requirements and consumer demand. Companies now routinely consider the environmental impact of their supply chains, including carbon footprints and resource depletion, as well as social factors like labor practices, human rights, and supplier diversity. This holistic approach enables organizations to not only mitigate a broader spectrum of risks but also to align their operations with the values of a more conscientious market, enhancing their resilience and competitive advantage in a rapidly changing world.

Denominator’s dataset helps corporates analyze all their suppliers globally, large and small, on their DEI and social footprint in accordance with a standardized framework, thereby circumventing disparate standards, certifications, and data availability. This ultimately enables corporates to scale their social impact significantly while minimizing their operational risk.

Supplier and spend diversity

Utilizing Denominator’s standardized framework for assessing the diversity- and social performance of suppliers globally enables clients to implement tangible initiatives, such as:

- Conducting comprehensive impact evaluations of global supply chains on 15+ diversity-and social performance indicators.

- Championing diverse supplier programs to foster an inclusive business ecosystem by identifying both new and existing diverse suppliers. Effectively direct spend towards these diverse businesses to support underrepresented communities.

- Utilizing performance assessments in contract renewal negotiations.

- Engaging with suppliers on improving diversity- and social profile.

Analyze supplier spend across regions and industries

Company Benchmarking

Diversity, Equity, and Inclusion (DEI) form fundamental pillars for a thriving corporation. Elevated levels of DEI not only enhance internal productivity and attract top talent but also play a crucial role in representing consumers and fostering customer loyalty. Additionally, robust DEI commitments are instrumental in capturing investor interest.

In today’s corporate landscape, Diversity, Equity, and Inclusion (DEI) practices are essential for fostering innovation and creating a dynamic workplace environment. A diverse team brings a variety of perspectives and ideas, driving creativity and problem-solving capabilities. By promoting inclusive work conditions, companies not only attract top talent from a broad range of backgrounds but also enhance employee satisfaction and retention. Furthermore, implementing robust DEI practices ensures that businesses align with the growing consumer and stakeholder expectations for responsible and ethical operations. This commitment to DEI reflects a company’s dedication to social responsibility and positions it as a leader in sustainable and forward-thinking business practices.

Leverage data insights for business strategies

Unlocking the advantages of DEI requires tailored initiatives that strategically enhance the corporation’s DEI commitment. Therefore, gaining a comprehensive understanding of current DEI performance is crucial. This in-depth analysis is facilitated by Denominator’s fact-based global DEI database.

- Excel in internal DEI commitments by measuring and monitoring DEI initiatives through obtaining transparent and comprehensive insights into existing DEI commitments that empower strategic DEI strategies and initiatives.

- Identify areas of competitive advantage and learn from top performance by assessing and benchmarking against peers and global standards on DEI.

- Meet consumer expectations, attract top talent and appeal to investors by leveraging data transparency to communicate DEI commitment to external stakeholders.

Benchmark against industry peers and global standards

Data

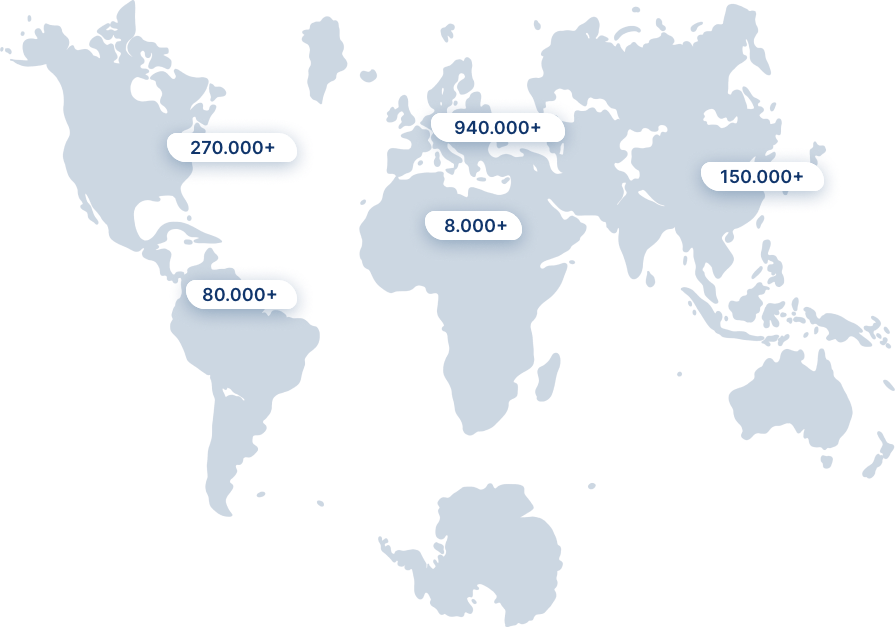

Denominator has a global database with data and ratings on countries, industries and more than 3.5 million public and private companies. The database spans over 650+ unique DEI data variables .

Did you know that most World maps resemble the Mercantor projection which does not reflect the true size of countries.

This map is based on Neil Kaye’s mosaic approach, but there are other maps projections such as Gail-Peters and Winkel

Ready to get started

I am interested in: