Earlier this year, a study conducted on behalf of the European Commission explored the integration of ESG factors into banks’ risk management processes, business strategies, and investment policies.

The study “Development of tools and mechanisms for the integration of ESG factors into the EU banking prudential framework and into banks’ business strategies and investment policies” provides a comprehensive overview of current practices and identifies a range of best practices for the integration of ESG risks. It outlines challenges and enabling factors associated with the development of a well-functioning EU market for green finance and sustainable investment.

Findings show that ESG integration is still at an early stage, but the pace of implementation needs to be accelerated to achieve effective ESG integration into banks’ risk management and business strategies.

To support this acceleration, the enhancements are particularly required on:

- Definitions of ESG

- Measurement methodologies

- Associated quantitative indicators

Data challenges and a lack of common standards continue to be the most prevalent challenges facing banks and supervisors. Data is the cornerstone for performing a wide range of ESG related activities, including risk measurement, product labeling, portfolio steering, and disclosure. The absence of common standards for ESG related issues impedes the comparability of information received and disclosed by banks, which creates information asymmetry among market participants.

At a global level, there is a lack of harmonized definitions and classification standards for a wider range of ESG products. Despite the development of international voluntary principles for some ESG market activities like green bonds, products are not always structured according to the same criteria. This hinders product comparison and effective asset allocation by banks.

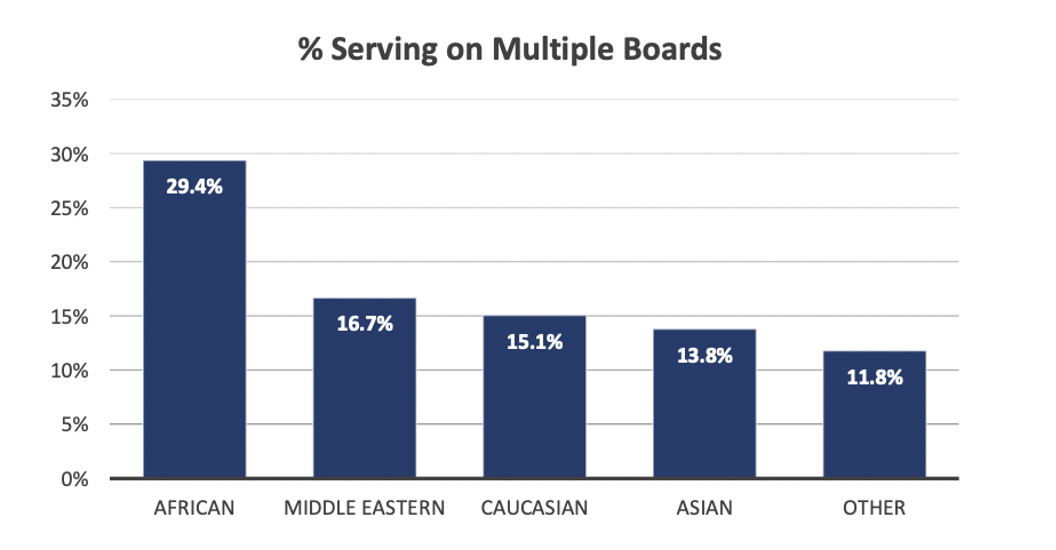

Denominator operates within the “S” of ESG, and our mission directly aligns with the findings of the European Commission by ensuring fact-based transparency to Diversity, Equity, & Inclusion (DEI) across organizations, industries, and countries. We have created the largest quantitative DEI database with up to 200 quantitative and globally comparable indicators on companies across the world. The data is created by structuring and standardizing data from thousands of sources across the multiple DEI sub-dimensions such as gender, race/ethnicity, age, sexuality, and disability.

The quantitative aspect of Denominator’s data is key. Historically, DEI data has been collected by asking C-level executives about their opinion on DEI, but this doesn’t work. For comparison, we don’t manage financial risk based on CFO’s opinions about financial performance – so why would this be the case for DEI? Quantitative data is essential for understanding and managing risk and Denominator is the solution within DEI.

Denominator is always looking for like-minded partners to expand the adoption of quantitative DEI data. If you want to partner up on this journey, please reach out to us at info@denominator.one

The study is authored by the Financial Markets Advisory Group within BlackRock and DG FISMA (Directorate-General for Financial Stability, Financial Services, and Capital Markets Union), and is based on the collection and aggregation of information from a wide range of representative stakeholders.

You can find the final study and the executive summary here.