As the role of human capital has become more central to the performance of a company, in 2020, the Security Exchange Commission (SEC) in the United States introduced regulation for human capital disclosures.

The SEC adopted a principle-based approach to filings under this regulation. Essential this means that besides having to disclose the number of employees there are no prescriptive disclosure mandates in the regulation. Instead, publicly traded U.S. companies must disclose all human capital measures that ‘are material to the performance of a registrant’. Measures are understood as material if they are relevant to the performance of a business. Furthermore, the SEC decided to not define human capital. With that, the SEC human capital regulation allows each company to decide what to disclose. The intention behind this is to facilitate an understanding of the business through the lens of management and the board of directors. In that sense, the approach is based on the principle of material relevance.

An advantage of a principle-based approach is that the principle applies to all companies. Even if the understanding and role of human capital differ between industries and companies, the condition of materiality can be tailored to all companies. There is hence no need to create a comprehensive framework that considers differences in the understanding of human capital. Moreover, since there is no definition of human capital, the regulation is also not bound to a specific point in time. Instead, if the understanding of human capital is subject to change in the future the regulation will still be applicable.

On the other hand, the lack of definitions and clear disclosure requirements create uncertainty for companies about what to disclose. Consequently, disclosures will differ across companies and industries and potentially create incomplete data availability. This will challenge the comparison of companies’ human capital efforts and thereby also make investment decisions more difficult.

The last two years have shown that even though the disclosures of human capital by companies have increased, information tends to be incomplete. Therefore, a petition by the “Working Group on Human Capital Accounting Disclosure” published in June 2022 has suggested more comprehensive rules and frameworks for human capital disclosure.

More specifically three reforms are advocated. First, a requirement for the disclosure of the portion of workforce cost that can be considered as an investment in the Management Discussion and Analysis section of annual reports. Second, equal treatment of the cost of the workforce with a suggestion for a more comprehensive framework that would include information about employee mean tenure and turnover, the various workforce compensations like benefits, health care, and training expenses as well as a distinction of full-time, part-time, and contingent workers. Lastly, the disaggregation of labor costs in the income statement. So far, the SEC has been discussing the reforms suggested in the petition. The SEC is acknowledging the importance of human capital in accounting and is currently reviewing the disclosures made by companies in the last two years under the principle-based approach. New regulations are expected to be issued soon.

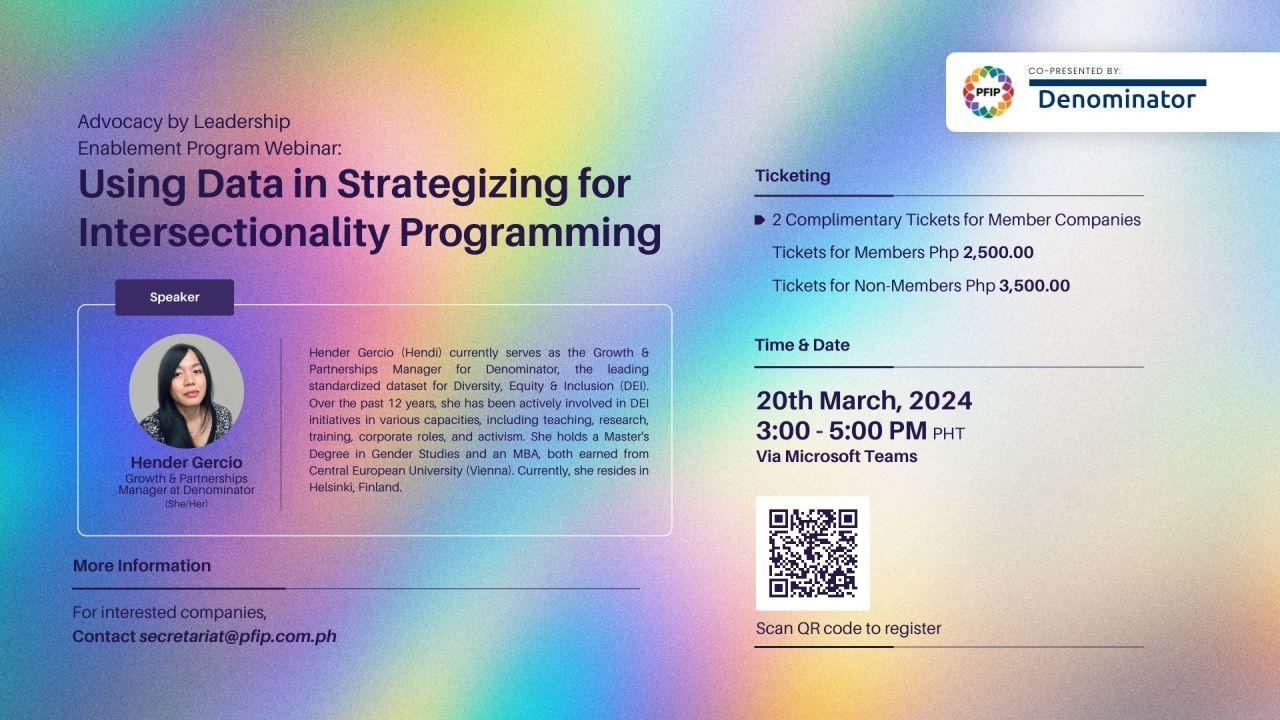

The petition by the working group and the response of the SEC shows how information on human capital is becoming essential for investors to evaluate companies. This means that there is an increasing demand for data on Diversity, Equity & Inclusion (DEI) performance. Denominator provides the world’s largest dataset on DEI performance and by standardizing unstructured data, Denominator’s DEI data and scores enable companies to understand human capital in their respective industries as well as across. The data can prepare companies for future regulations and provide investors with the needed insight into the DEI performance of companies.