This interview as originally published by FINBOURNE.

In the latest of our Culture and Diversity interview series, we speak with Anders Rodenberg, CEO at Denominator, a global Diversity, Equity, & Inclusion (DEI) data & scoring provider. Covering more than 3 million public and private companies in 195+ countries, and 85+ industries on 650+ DEI-specific data variables, Denominator brings quantifiable and standardised transparency to DEI performance.

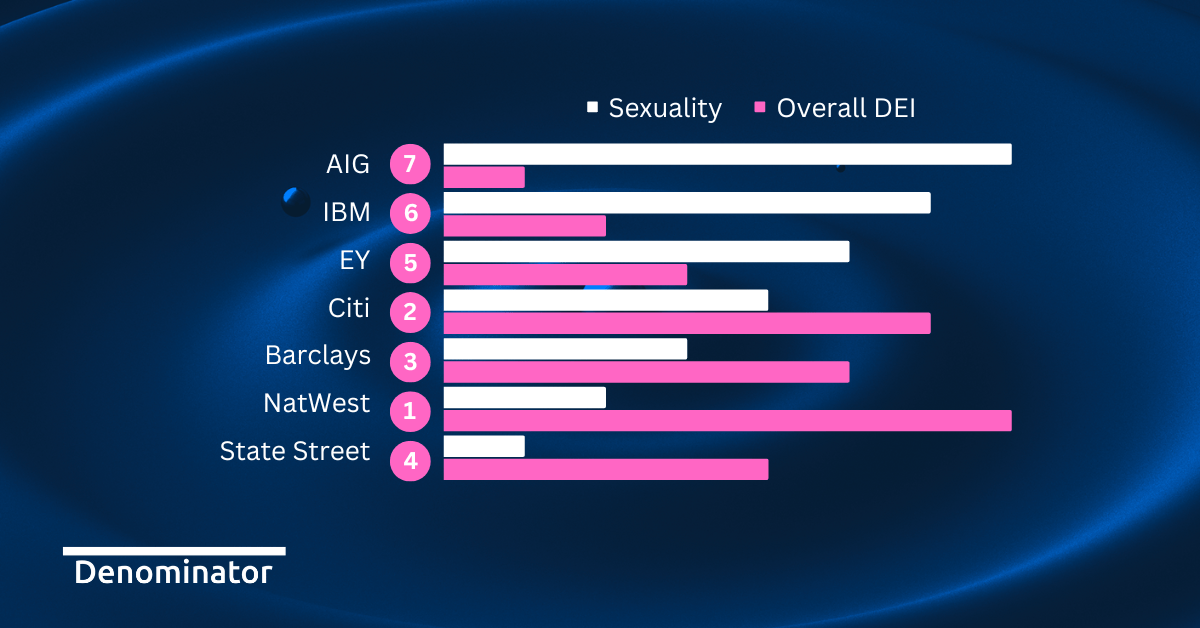

The DEI data is collected at both Board, Executive, and Company level, and takes a holistic approach to DEI with 15 dimensions of DEI such as gender, race/ethnicity, disability, age, education, sexuality, etc. This unique granularity drives the most sophisticated rating methodologies, enabling investors to include DEI into their investment and ownership decisions and understand the S in ESG.

In this interview, Anders tells us about the ESG data evolution in financial services and the lasting benefits that clear, actionable DEI data brings to the workplace.

Tell us about your career to date, and your current role as CEO of Denominator?

Prior to becoming the CEO of Denominator, I spent more than a decade at Bureau van Dijk and Moody’s Analytics. I have always worked with quantifiable and standardised data; first within financial risk, then for tax & transfer pricing, anti-money laundering, KYC, sanctions, and other regulatory areas, next up was Cyber Risk, and lastly ESG. In hindsight, my career has followed the evolution of risk from a simple credit view to something multifaceted where it is now. The common denominator to understanding and managing each of these new areas was data, and I have seen first hand the necessity of something as “boring” as quantifiable and standardised data for knowledge and accountability. Denominator brings global transparency to the last data frontier, DEI, and it was therefore a natural choice, not only given my background, but more importantly because of the impact this data creates.

Today I do a little bit of everything, but my most important job is to engage with people – both inside and outside of Denominator. Data might be the foundation of knowledge and accountability, but it requires people to turn knowledge and accountability into solutions and improvements. In the end, my job is about people. We are already seeing the effect of Denominator’s data driving new investment decisions and must admit it feels good to help drive change in investment decisions.

We are all familiar with the terms ‘ESG’ and ‘sustainability’, but they have always had an environmental focus. Why is the intersectionality of these terms so important in highlighting the relevance of the people behind climate solutions?

Without understanding the S in ESG it becomes hard to implement effective climate solutions. As an example, a large supermarket chain in Northern Europe said it would stop selling products that had been flown in, and at the same time scientists in Northern Europe had successfully grown coffee in a laboratory. Both these made the news as great climate solutions, but none of these consider the S as the majority of fruit being flown in are non-durable fruits from developing countries around the equator, and most coffee is grown in the same regions. Implementing this type of “solution” too fast will just take away the livelihood of people in these developing countries and create similar non-liveable conditions as climate change.

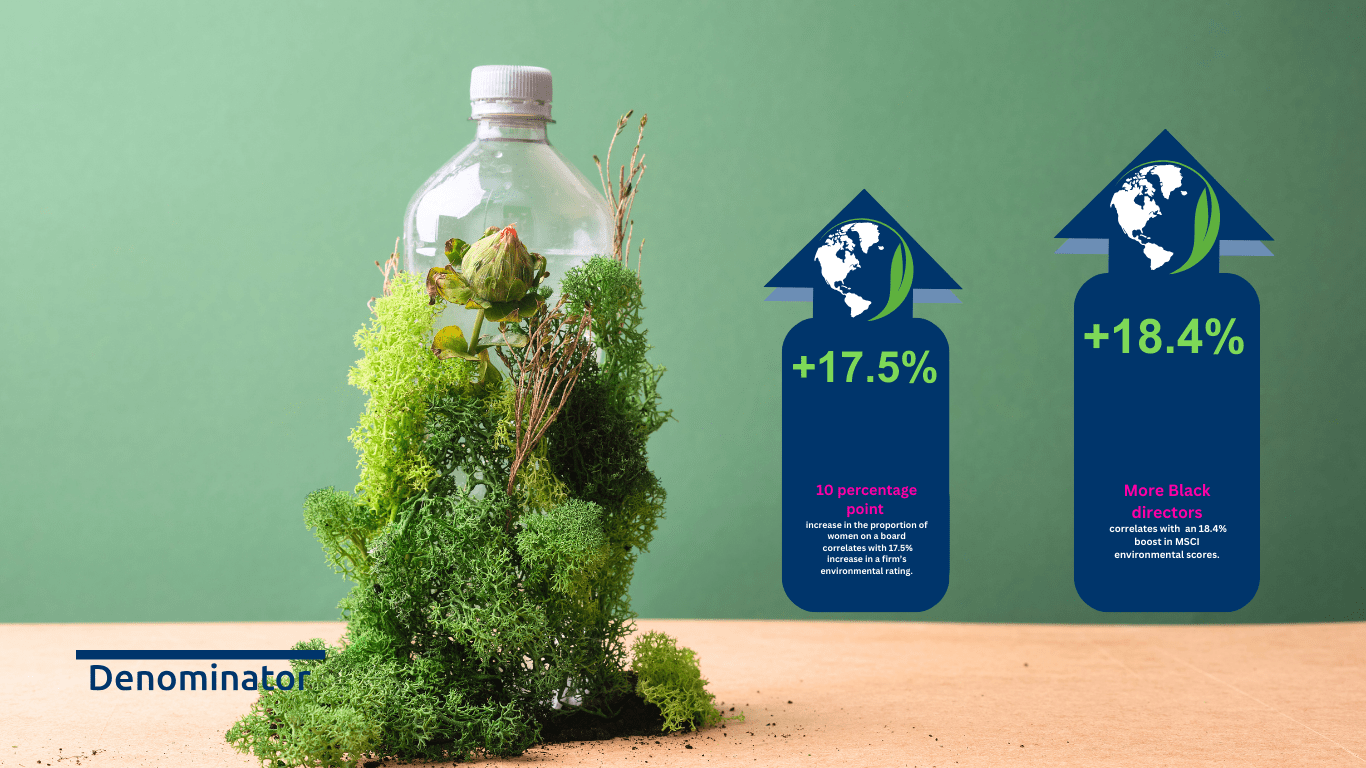

Secondly, the biased focus on the E has essentially created mislabelling of most ESG efforts. Mislabelling creates mistrust and adversity – the opposite of what is needed to implement effective climate solutions. As our analysis, comparing the world’s 100 most sustainable companies ranked by Corporate Knight (mainly E-focused) with Denominator’s total DEI score, showed, there is a minimal correlation between the two rankings which highlights that companies doing well on the E do not necessarily perform well on the S. Moreover, many funds presented as best in ESG are in fact only best in class from an E perspective while some have large exposure to bottom quartile performers on DEI.

The PRI (Principles for Responsible Investing) recently released the statement, ‘investors across all major asset classes can and should integrate DEI considerations into investment ownership decisions’.[1] The inclusion of DEI data is becoming a regulatory pressure as well as reputational. How is Denominator helping to make DEI data more available within financial services?

The PRI made their position on DEI very clear last year, and I think their position aligns with many investors’ views, especially the PRI-signatories. We know data availability has been one reason why many investors have not done more in this area, and whilst data availability was an issue 3 years ago it is no longer the case. Today it is possible to get DEI data, scores, and ratings on both board, executive, and company levels on companies in all countries across the world. And we are not just talking about gender, but also race/ethnicity, age, disability, sexuality, education, family, nationality, and many more dimensions of DEI.

This is essentially what we do at Denominator. By bringing the global and granular DEI data to investors, we are not only allowing investors to live up to PRI’s position, but we are also allowing investors to generate alpha, and most importantly decide how they want to deploy or manage their capital. It is thought-provoking that most investors today do not have the option to for example provide their capital to companies that are performing well on disability, or ensure that their capital does not go to companies that underperform on gender and race/ethnicity. Most already have these options when it comes to tobacco, landmines, or deforestation. DEI is next.

Girls that Invest[2] highlights that in the last ten years, the 41 women-led companies in the S&P 500 have outperformed the 459 male-led companies. These companies generated higher returns whilst outperforming on Denominator’s DEI factors. How are these results a catalyst for further change in the industry, not just in terms of gender but across all of Denominator’s 15 dimensions?

It is quite an interesting finding. Our data shows that the women-led companies perform 7% better on Denominator’s total DEI score than the male-led companies in S&P 500. Women-led companies in S&P 500 especially perform better on disability (33 %), gender (20%), family (14%), and age (13%) while the male-led companies perform slightly better on health (4%).

Results like these show the intersectionality that often occurs between DEI dimensions. Both negative and positive. That said it is not always the case and some companies that are in the top quartile on gender dimension are at the bottom quartile on race. The conclusion is that the insights are found in the details and by bringing a holistic approach to DEI, new conversation, knowledge, and progress will be made.

Technology plays a critical role in overcoming these data availability challenges. Can you explain why partnerships, such as with FINBOURNE, are crucial to empowering organisations with the data and insights they need to sustain their bottom lines?

DEI data and scores are the foundation, however, to apply and turn it into valuable insights, you need the right technology. Therefore, the partnership between FINBOURNE and Denominator plays a crucial role in empowering investors by providing the necessary data and insights for decision-making. Our collaboration is instrumental in supporting the global Buy-Side in gaining a competitive advantage in an evolving world that prioritises value-based investments. Through the utilisation of FINBOURNE’s cutting-edge data management systems and platforms, our partnership streamlines the aggregation and organisation of DEI data, resulting in improved accessibility and granular insights into DEI performance.

Denominator is dedicated to data, and our partnership with FINBOURNE reflects a shared commitment to make DEI data accessible and actionable to serve as a powerful strategic tool for future investments and decision-making.

[1] https://www.unpri.org/download?ac=15712

[2] https://www.linkedin.com/posts/femalequotient_the-numbers-speak-for-themselves-check-activity-7050156394645237760-2IMQ?utm_source=share&utm_medium=member_desktop