The European Union has been actively pursuing initiatives like the Non-Financial Reporting Directive (NFRD) and Corporate Sustainability Reporting Directive (CSRD) to improve ESG reporting standards. However, these efforts are not without their share of challenges, including the absence of a common sustainability definition, variations in ESG scoring methodologies, and the significant adjustments that may be required for companies transitioning to CSRD.

This represents the central theme of a recent study titled “Bridging the Gap – Challenges and Strategies in ESG reporting for European Banks in the Transition from NFRD to CSRD” conducted at IT University of Copenhagen (ITU) with the use of data from Denominator, Refinitiv, and EY.

The research explores the pressing socio-environmental challenges that demand collective action from citizens and corporations, particularly within the banking sector. As well as the heightened stakeholder expectations for transparency and accountability in Environmental, Social, and Governance (ESG) reporting where banks are finding themselves at the forefront of a pivotal movement.

Key Findings in the Study

ESG reporting plays a significant role in promoting sustainable transparency and accountability in the corporate realm. NFRD has witnessed remarkable growth, with banks actively integrating these practices into their strategies to bolster their standing among society and stakeholders.

The research also argues that the introduction of CSRD in early 2024 reflects the growing demand for standardized reporting practices, intending to establish clear definitions and reporting standardization. However, achieving this standardization remains a subject of debate due to variations in criteria definitions, data collection, and processing methodologies, resulting in opaque ESG scores.

Key Recommendations from the Study:

- Utilizing the Controversy methodology to track public opinion and media attention, aiming to raise awareness of the public’s sentiments and enhance the credibility of banks in the realm of sustainability.

- Country-Specific Indices: To incorporate country-specific indices into all three reporting pillars to account for the influence of factors like the country of operation, enabling contextualization of data.

- Size vs. ESG Ratings: Investigate the correlation between the size of banks and their ESG ratings, emphasizing the use of financial statements to contextualize reported ESG data for a nuanced interpretation.

Denominator’s DEI Scores and Ratings

Denominator offers valuable contributions towards addressing the gaps in the field. The analysis makes use of more than 125 DEI data points on each of the analyzed banks by using DenominatorGlobal: DenominatorGlobal is an expansive global database, encompassing data and ratings for over 3 million public and private enterprises across 85+ industries and 195+ countries. This extensive database includes data on more than 650 Diversity, Equity, & Inclusion (DEI) specific variables, making it an empowering tool for DEI insights.

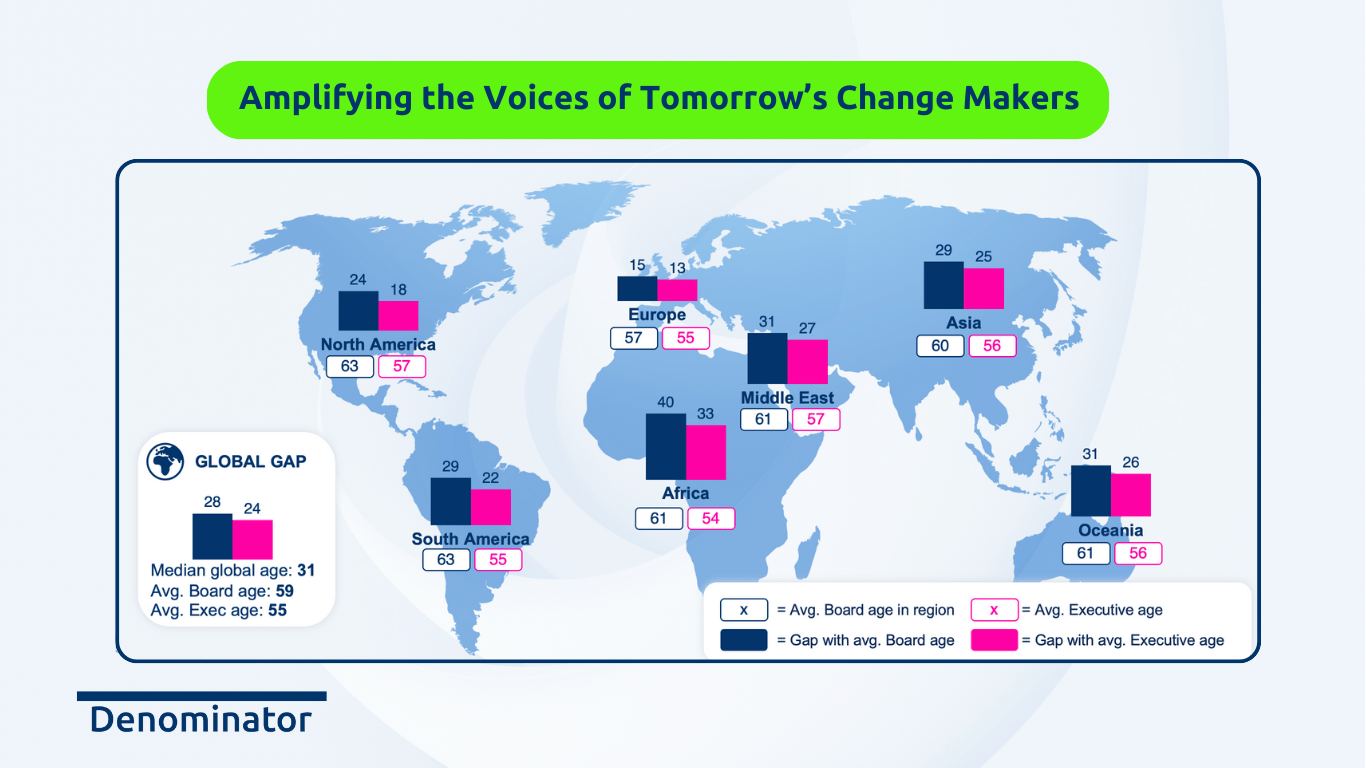

As an answer to one of the recommended solutions in the study, the analysis also explores the index DenominatorCountry (formerly known as the DEI Country Index, as indicated in the study). An index which assesses the performance of countries in Diversity, Equity, & Inclusion. The index combines countries’ scores, derived from 70+ DEI indicators. The indicators are grouped into multiple DEI dimensions within the three pillars of Diversity, Equity, & Inclusion with sub-dimensions such as Gender, Race/Ethnicity, Age, Sexuality, Education, Health, Disability, etc.

The index also consists of two main components: The first component being a country score based on the DEI performance across all indicators and the second component being a company score based on the average DEI performance of companies operating in the country.

Denominator’s contributions and solutions were deemed by the study to be valuable for the reporting landscape due to their ability to provide holistic and comprehensive insights to DEI and ESG reporting, while also considering contextual factors.

Finally, the research argued that while CSRD may not result in immediate standardization, it can serve as an initial step toward enhancing accountability in ESG reporting. Advising that banks take proactive measures to assess and adapt their practices to align with the evolving reporting demands, even as CSRD takes effect in the upcoming year of 2024.

To learn more about the study, contact the authors Victor Mac van Hauen Rørbye and Samuel Bæk Bramming.

To learn more about Denominators DEI data and solutions, please reach out at info@denominator.one or by filling out the form below.