A newly published study by Eurosif investigates how climate-related data is utilized in investment procedures. The study focuses on financial market professionals in Europe who manage assets ranging from under €50 million to over €500 billion. Mainly, it focuses on their demand for more comprehensive and standardized climate-related data.

The study provides valuable insights and recommendations for enhancing climate-related information and reporting in corporate disclosures from investors’ perspective.

The Eurosif report highlights the following needs from investors:

- The need to continue promoting the availability, quality, and comparability of company-reported climate-related information through regulatory initiatives like the development of the

- Environmental, Social, and Governance Reporting Standard (ESRS).

For transparency requirements for external data and rating providers to ensure clarity on their methodologies, research processes, and data sources. - The importance of collaboration with the scientific community to develop accurate, science-based climate-related indicators, particularly with a focus on forward-looking metrics.

These recommendations aim to strengthen climate-related reporting and provide decision-makers with reliable and useful information for informed decision-making. The report further highlights the growing demand for standardization from EU policymakers to support this objective.

In addition to these requirements, the report argues that the need for well-defined metrics and reporting standards is expected to expand to other ESG aspects beyond climate.

Paving the way for what to expect for the social dimension of ESG

The growing demand for comprehensive climate-related information is driving expectations for similar frameworks and processes in the social aspect of ESG. Just as asset managers, stakeholders, and investors seek standardized and holistic climate-related data, their attention has also shifted towards DEI and the social aspect within the ESG landscape.

The study highlights the significant role played by investors and asset managers in advocating for greater standardization and transparency in ESG-related data, particularly from EU policymakers. As a result, regulatory requirements are evolving to align with these demands for standardized and transparent information.

Investors in the study also expressed two primary motivations for their demand for better data. Firstly, they seek improved risk management capabilities, recognizing the importance of accurate information in assessing and mitigating potential risks. Secondly, they desire better opportunity forecasting, aiming to identify and capitalize on companies showing positive promise when it comes to their ESG commitments. Reliable forward-looking metrics are key when it comes to the usability of the data.

By recognizing the pivotal role of investors in shaping the ESG landscape and their demands for standardized data, we can anticipate significant developments and advancements in both climate-related and social-related reporting.

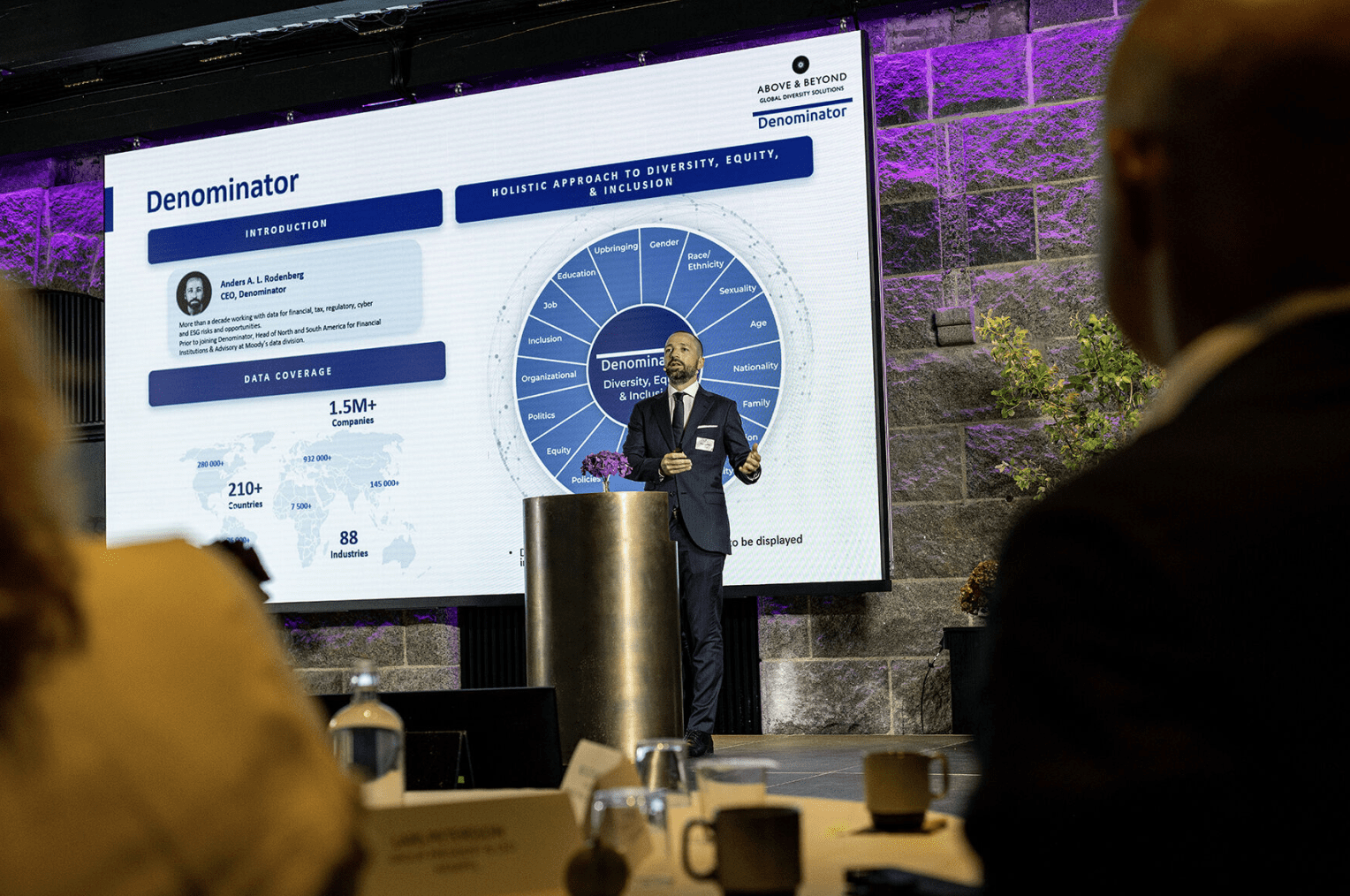

While there is still some way to go regarding standardization of climate-related data for investors, with Denominator the need for standardized DEI data within the social dimension of ESG is no longer a distant wish—it is already here. Driven by the growing demands, the evolution of standardized DEI data and ratings has gained significant momentum in recent years. Denominator has been at the forefront of this development and is dedicated to making comprehensive DEI data accessible and readily available for institutional investors.

If you strive to stay ahead of the curve, we invite you to explore our free trial or reach out to us at info@denominator.one for more information.

Let´s embrace the power of comprehensive DEI data and shape the future of responsible investment today.